New Homes For South Park

New homes are coming to South Park!

The City of Houston is partnering with To Each His Home Community Redevelopment Corporation (TEHH) and Horizon Residential Communities, LLC, to develop homes in the South Park neighborhood of Houston.

Through the Affordable Home Development Program (AHDP), the City of Houston will contribute a forgivable loan of $5,602,794.00 in Uptown TIRZ Series 2021 Affordable Homes Funds to finance the acquisition and infrastructure for the development.

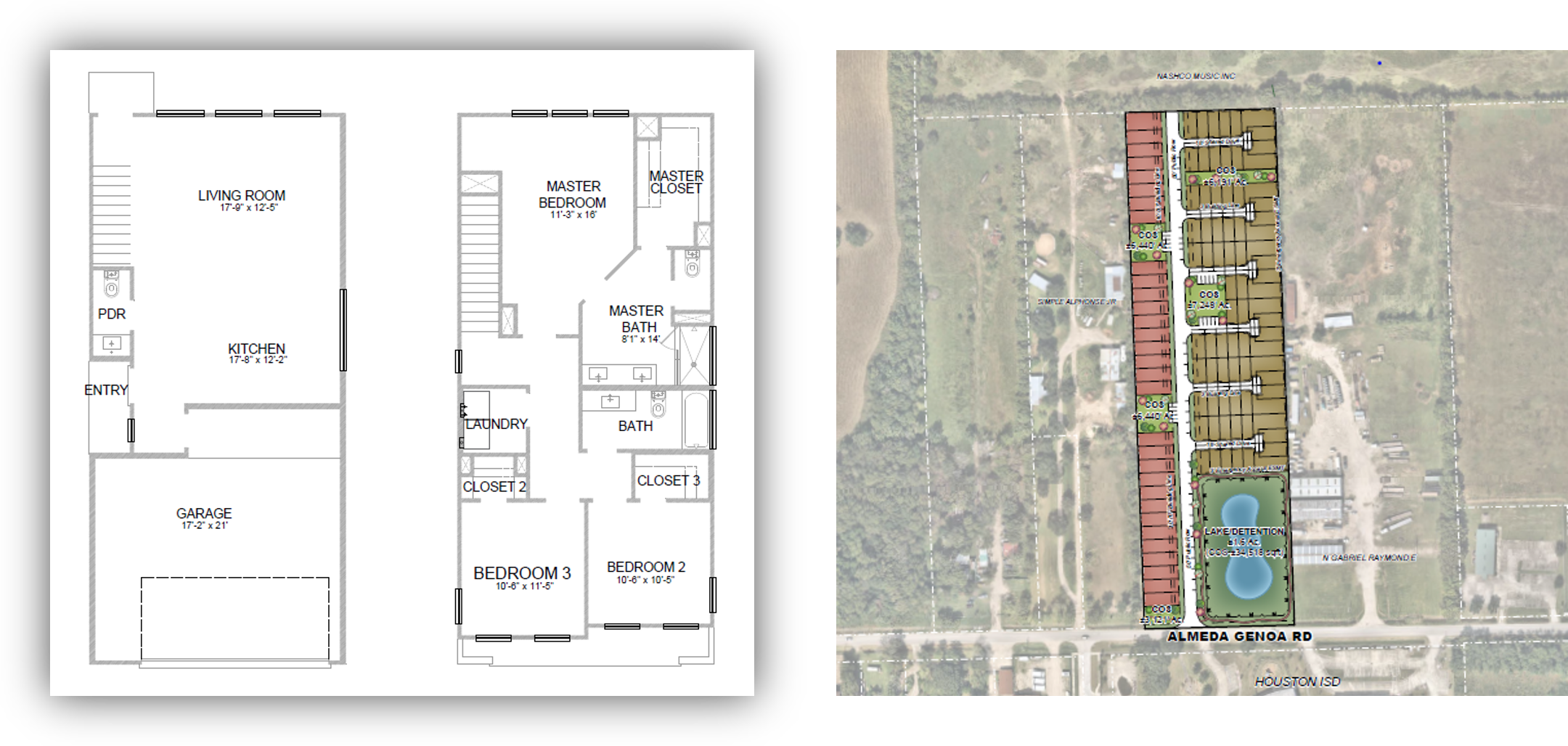

To Each His Home Community Redevelopment Corporation and Horizon Residential Communities, LLC will oversee the horizontal and vertical construction necessary to prepare the lots for the new construction of 91 single-family homes, including 60 affordable homes and 31 market-rate homes, located at 5003 Almeda Genoa, Houston, Texas 77048.

The development features three-bedroom single-family detached home designs for homebuyers earning up to 120% of the Area Median Income. The price points for affordable homes range between $245,000.00 to $280,000.00.

South Park is in Houston’s southside, bordered by Loop 610 to the North, Sims Bayou to the South, Mykawa Road to the East, and local streets west of Martin-Luther King Boulevard. South Park is a series of tract-home subdivisions developed along South Park Boulevard during the 1950s. The oldest subdivision consists of small frame homes on streets named for World War II battles that the original homebuyers, many of whom were returning veterans, knew from personal experience.

Please visit the Superneighborhood 72 – South Park page to learn more.

Horizon Residential Communities, LLC

Horizon is a State of Texas Certified Historically Underutilized Business (HUB), a City of Houston Minority Business Enterprise (MBE), a Women Business Enterprise (WBE), and a Small Business Enterprise (SBE). It is a premier Houston general contractor, job order contractor, developer, and consulting expert in the construction industry. Its mission is to provide quality and value to all clients safely.

Sadie Rucker is the President of Horizon International Group, LLC. She is a native Houstonian and the 2021 former president of the Women Contractors Association Houston Chapter. She graduated from Texas Southern University and holds a master’s degree in training and development from the University of Houston. She has over 25 years of experience as a project principal and as a project executive at Horizon.

Al Kashani is the Vice President of Horizon International Group, LLC. He is responsible for driving Horizon's growth and creating operational strategies and is instrumental in overseeing all construction management and property development. He is a fourth-generation developer, builder, and contractor with over 35 years of experience in real estate development and asset management. A graduate of the University of Houston, Cullen College of Engineering, Kashani is widely known as an advocate in the community, creating MWBE|HUB opportunities and community engagement throughout the Greater Houston Area.

To Each His Home Community Redevelopment Corporation (TEHH)

To Each His Home Community Redevelopment Corporation (TEHH), began in 2012. TEHH is a Texas Domestic Non-Profit Corporation organized and operated exclusively for charitable purposes. TEHH mission is to improve the communities they serve by providing economic and educational opportunities through homeownership education and counseling, foreclosure prevention counseling, and tenancy rental housing counseling.

Like many innovative companies, Horizon International Group, LLC began in 1994 as a modest garage apartment. Principals Sadie Rucker and Al Kashani took years of industry work and five generations of development and construction experience and established Horizon International Group, LLC.

About the Affordable Home Development Program

Key Facts

-

The program aims to create new homeownership opportunities for residents.

-

Developments located across Houston.

-

Developments are mixed-income. At least 40 homes in each AHDP development will be attainable to households earning up to 120% of the Area Median Income (Español) or less. For a family of four, for example, this would mean earning $106,300 or less as of 2022.

FAQs - Frequently Asked Questions

Note: The following FAQ pertains to the City’s administration of the Affordable Home Development Program. The City’s developer partners may have additional program guidelines.

Q: How do I buy a home? - Answer

A: Homebuyers will purchase market and attainable rate homes directly through the developers. The City will partner with the developer to co-market and perform income eligibility reviews for the attainable rate homes.

Q: What role does the City have in the homebuyer process? - Answer

The City will partner with the developer to comarket the community. This includes cohosting community meetings, and webinars.

Additionally, the City will perform income eligibility reviews for homebuyers purchasing an attainable rate home.

Q: Can I use down payment assistance programs to help buy a home? - Answer

A: Homebuyers purchasing affordable or market rate homes may use down payment assistance programs available to them through their private mortgage lender or other entities.

Q: What do you mean by “attainable rate” homes? - Answer

A: Generally, rent or mortgage payments should not exceed 30% of household gross income. The City’s financial investment through the Affordable Home Development Program will decrease the purchase price from the current market rate to the homebuyer’s secured fixed rate mortgage to make homes more attainable.

Q: How will I know when homes are available to purchase? - Answer

A: The developer will market when the homes are available to purchase. HCD will also inform the community through the HCD Homebuyers Hub page, and HCD social media.

Q: How will the homebuyer process work? - Answer

A: The first step for every homebuyer will be to secure a 30-year fixed rate mortgage from a lender. For homebuyers purchasing a market-rate home, they will then continue the traditional homebuyer process.

Homebuyers purchasing an attainable-rate home will also need to attend a HUD-certified eight (8) hour homebuyer education course and earn up to 120% of the Area Median Income as determined by HUD when purchasing the home. The City’s financial investment through the Affordable Home Development Program will decrease the purchase price from the current market rate to the homebuyer’s secured fixed rate mortgage to meet the attainable home price.

Q: Is there an affordability period or secondary lien on the homes?- Answer

A: The City will not impose a secondary lien on market-rate homes.

The City will impose a five-year secondary lien on attainable rate homes. The secondary lien will be forgiven at the end of the five-year period. Please note that individual developers may impose a longer secondary lien on attainable rate homes.

Q: Will there be any difference between market-rate homes and attainable homes? - Answer

A: No, all homes will have the same construction quality, finishes, and appliances.