New Homes for South Houston – Garver Heights & Zuri Gardens

New homes are coming to South Houston – Garver Heights & Zuri Gardens!

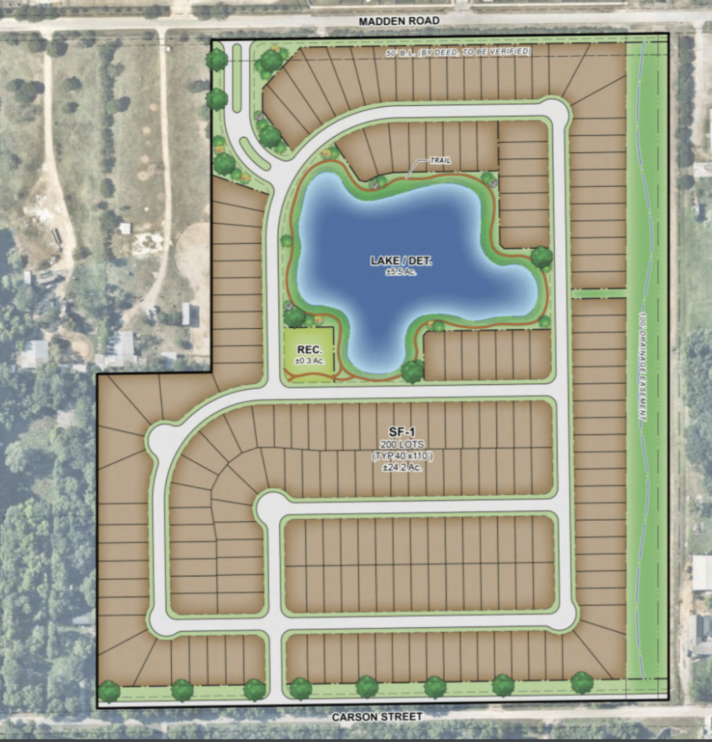

The City of Houston is partnering with Cole Klein Builders to develop at two locations in the Minnetex neighborhood. Cole Klein will build 200 homes, including 160 affordable and 40 market rate homes at Garver Gardens located at Martindale Road and Carson Road. Cole Klein will also build 80 affordable homes at Zuri Gardens located at Madden Lane and Carson Road. The homes will be sold to homebuyers earning up to 120% of the Area Median Income.

Through the Affordable Home Development Program (AHDP), the City of Houston will contribute a forgivable loan of $1,063,435.97 for Garver Gardens and $1,836,564.03 for Zuri Gardens from the Uptown TIRZ Series 2021 Affordable Homes Funds to make the homes more affordable for Houstonians.

The expansion of South Beltway 8 through the southern edge of the Minnextex neighborhood has brought new development to the area. The small and large-lot subdivisions, scarce homes, and scattered industrial facilities are surrounded by acres of raw land, with quick access to the rest of the Houston metropolitan area. Please visit the Super Neighborhood 77 – Minnetex page to learn more.

Cole Klein Builders is a residential new construction company in Houston, Texas. Cole Klein formally started in 2016 to serve as an affordable quality home builder in Houston. Before 2016, Cole Klein’s portfolio included production housing, high-end custom home building, townhouse and restaurant design and construction, commercial buildouts, land development, and syndication.

About the Affordable Home Development Program

Key Facts

-

The program aims to create new homeownership opportunities for residents.

-

Developments located across Houston.

-

Developments are mixed-income. At least 40 homes in each AHDP development will be attainable to households earning up to 120% of the Area Median Income (Español) or less. For a family of four, for example, this would mean earning $106,300 or less as of 2022.

FAQs - Frequently Asked Questions

Note: The following FAQ pertains to the City’s administration of the Affordable Home Development Program. The City’s developer partners may have additional program guidelines.

Q: How do I buy a home? - Answer

A: Homebuyers will purchase market and attainable rate homes directly through the developers. The City will partner with the developer to co-market and perform income eligibility reviews for the attainable rate homes.

Q: What role does the City have in the homebuyer process? - Answer

The City will partner with the developer to comarket the community. This includes cohosting community meetings, and webinars.

Additionally, the City will perform income eligibility reviews for homebuyers purchasing an attainable rate home.

Q: Can I use down payment assistance programs to help buy a home? - Answer

A: Homebuyers purchasing affordable or market rate homes may use down payment assistance programs available to them through their private mortgage lender or other entities.

Q: What do you mean by “attainable rate” homes? - Answer

A: Generally, rent or mortgage payments should not exceed 30% of household gross income. The City’s financial investment through the Affordable Home Development Program will decrease the purchase price from the current market rate to the homebuyer’s secured fixed rate mortgage to make homes more attainable.

Q: How will I know when homes are available to purchase? - Answer

A: The developer will market when the homes are available to purchase. HCD will also inform the community through the HCD Homebuyers Hub page, and HCD social media.

Q: How will the homebuyer process work? - Answer

A: The first step for every homebuyer will be to secure a 30-year fixed rate mortgage from a lender. For homebuyers purchasing a market-rate home, they will then continue the traditional homebuyer process.

Homebuyers purchasing an attainable-rate home will also need to attend a HUD-certified eight (8) hour homebuyer education course and earn up to 120% of the Area Median Income as determined by HUD when purchasing the home. The City’s financial investment through the Affordable Home Development Program will decrease the purchase price from the current market rate to the homebuyer’s secured fixed rate mortgage to meet the attainable home price.

Q: Is there an affordability period or secondary lien on the homes?- Answer

A: The City will not impose a secondary lien on market-rate homes.

The City will impose a five-year secondary lien on attainable rate homes. The secondary lien will be forgiven at the end of the five-year period. Please note that individual developers may impose a longer secondary lien on attainable rate homes.

Q: Will there be any difference between market-rate homes and attainable homes? - Answer

A: No, all homes will have the same construction quality, finishes, and appliances.