New Homes For Northside

New homes are coming to Northside!

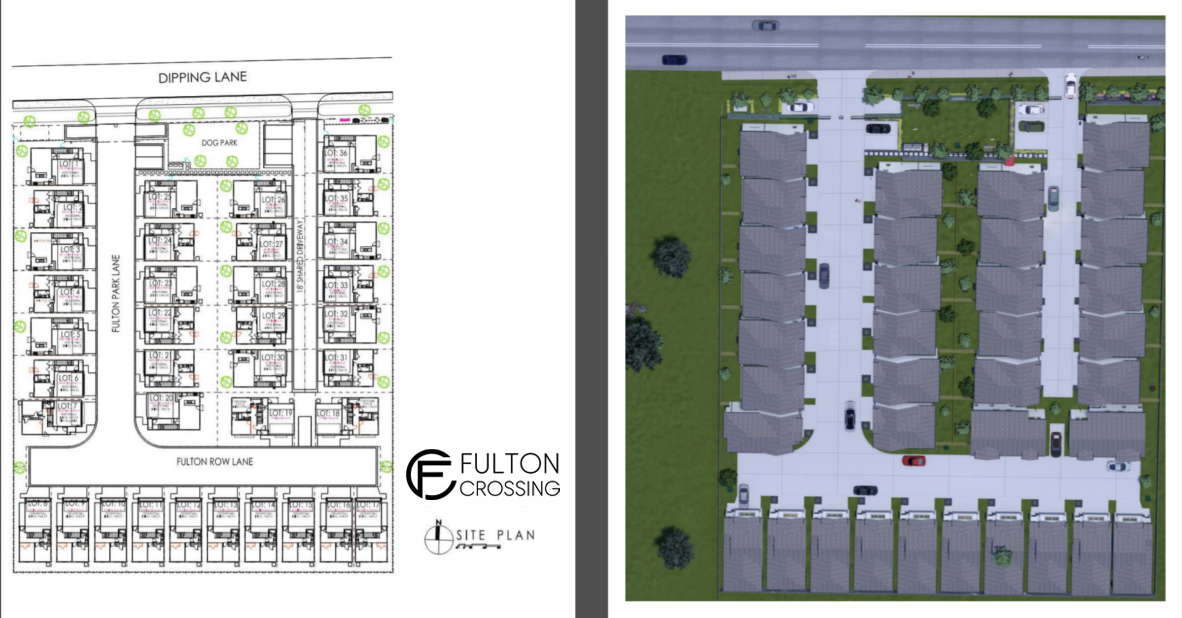

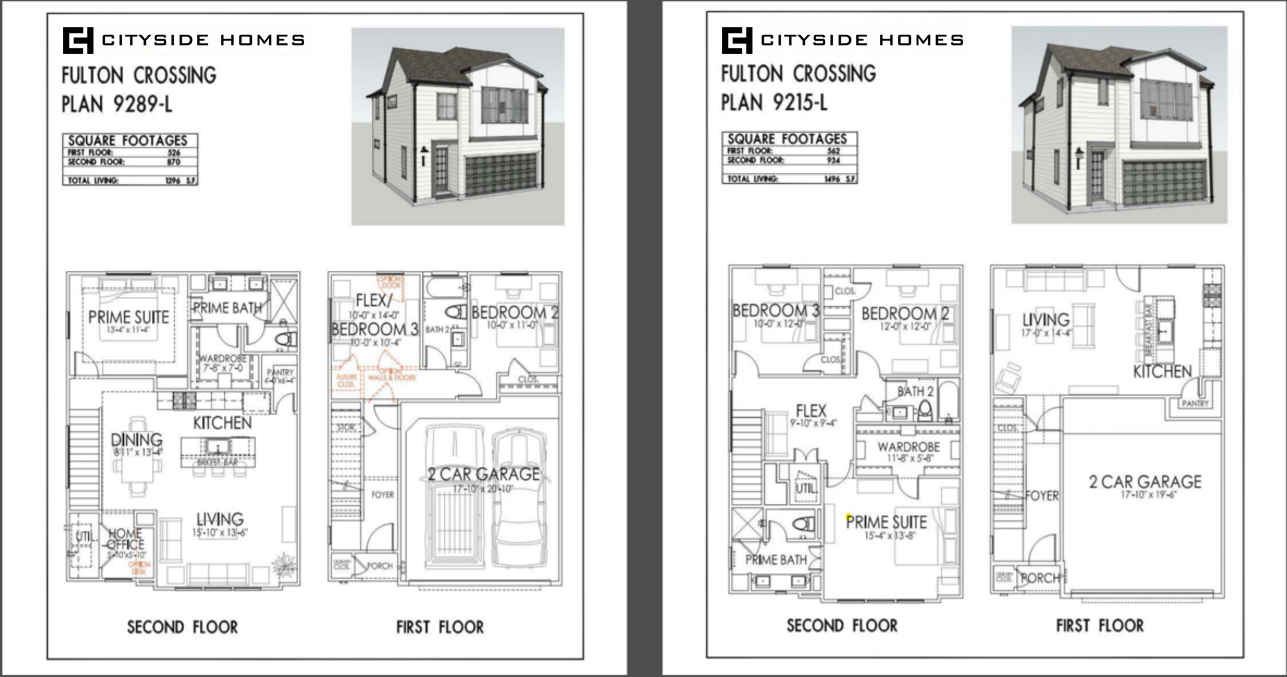

The City of Houston is partnering with Cityside Homes to develop 44 Dipping Lane and 1000 Patton Street in the Northside neighborhood. Cityside will build 59 homes, including 40 affordable and 19 market-rate homes. The homes will be sold to homebuyers earning up to 120% of the Area Median Income.

Through the Affordable Home Development Program (AHDP), the City of Houston will contribute a forgivable loan of $5,200,000.00 from the Uptown TIRZ Series 2021 Affordable Homes Funds to make homes more affordable for Houstonians.

Interested in buying an attainable home financed by the City of Houston? Complete your application today!

The area is largely single-family residential with large apartment complexes located near the I-45 (North Freeway) on the western edge of the community. The two major roadways, I-45 and the Hardy Toll Road, provide access to the area. Please visit the Super Neighborhood 45 – Northside page to learn more.

Cityside Homes was formed in 2011 by a senior team with over 200 years of homebuilding expertise. Cityside has built over 1,000 exceptional homes in 100 communities throughout Houston with the conveniences and amenities of inner-city living.

Learn More

Photo Gallery

About the Affordable Home Development Program

Key Facts

-

The program aims to create new homeownership opportunities for residents.

-

Developments located across Houston.

-

Developments are mixed-income. At least 40 homes in each AHDP development will be attainable to households earning up to 120% of the Area Median Income (Español) or less. For a family of four, for example, this would mean earning $106,300 or less as of 2022.

FAQs - Frequently Asked Questions

Note: The following FAQ pertains to the City’s administration of the Affordable Home Development Program. The City’s developer partners may have additional program guidelines.

Q: How do I buy a home? - Answer

A: Homebuyers will purchase market and attainable rate homes directly through the developers. The City will partner with the developer to co-market and perform income eligibility reviews for the attainable rate homes.

Q: What role does the City have in the homebuyer process? - Answer

The City will partner with the developer to comarket the community. This includes cohosting community meetings, and webinars.

Additionally, the City will perform income eligibility reviews for homebuyers purchasing an attainable rate home.

Q: Can I use down payment assistance programs to help buy a home? - Answer

A: Homebuyers purchasing affordable or market rate homes may use down payment assistance programs available to them through their private mortgage lender or other entities.

Q: What do you mean by “attainable rate” homes? - Answer

A: Generally, rent or mortgage payments should not exceed 30% of household gross income. The City’s financial investment through the Affordable Home Development Program will decrease the purchase price from the current market rate to the homebuyer’s secured fixed rate mortgage to make homes more attainable.

Q: How will I know when homes are available to purchase? - Answer

A: The developer will market when the homes are available to purchase. HCD will also inform the community through the HCD Homebuyers Hub page, and HCD social media.

Q: How will the homebuyer process work? - Answer

A: The first step for every homebuyer will be to secure a 30-year fixed rate mortgage from a lender. For homebuyers purchasing a market-rate home, they will then continue the traditional homebuyer process.

Homebuyers purchasing an attainable-rate home will also need to attend a HUD-certified eight (8) hour homebuyer education course and earn up to 120% of the Area Median Income as determined by HUD when purchasing the home. The City’s financial investment through the Affordable Home Development Program will decrease the purchase price from the current market rate to the homebuyer’s secured fixed rate mortgage to meet the attainable home price.

Q: Is there an affordability period or secondary lien on the homes?- Answer

A: The City will not impose a secondary lien on market-rate homes.

The City will impose a five-year secondary lien on attainable rate homes. The secondary lien will be forgiven at the end of the five-year period. Please note that individual developers may impose a longer secondary lien on attainable rate homes.

Q: Will there be any difference between market-rate homes and attainable homes? - Answer

A: No, all homes will have the same construction quality, finishes, and appliances.