Legislative Battles

SB 1438: Disaster Tax Cap Reforms

Senate Bill 1438 by Senator Bettencourt modifies the tax rate calculation provision for taxing units during a disaster to restrict a city from opting into an 8 percent voter-approval rate calculation during a pandemic or other disaster in which property is not physically damaged.

Over the interim and during the early parts of this session, there had been some confusion regarding the City of Houston’s adopted tax rate and the 3.5% versus 8% provisions set forth under Senate Bill 2 passed during the 86th Legislative Session.

To be clear, Houston reduced its tax rate for the 6th time in 7 years. The savings are reported at $12.16 for the homeowner of a $200,000 property and is projected to raise $11 million more in total revenue, reflecting an increase of 0.9%.

The confusion comes from the fact the City of Houston has its own property tax cap.

- The City of Houston’s revenue cap, added to the City Charter by voters in 2004, requires voter approval for increases in ad valorem taxes in future years above a limit equal to the lesser of the actual revenues in the preceding fiscal year, plus 4.5%, or a formula that is based upon the actual revenues received in fiscal year 2005 adjusted for the cumulative combined rates of inflation and the City’s population growth.

The City of Houston has a property tax cap that has been in effect since FY 2006 (voter -approved as Proposition 1). In FY 2007, voters approved collecting additional revenues above the cap of $90 million for police, fire, and emergency medical services (Proposition H).

In establishing a tax rate for FY 2021, the City started with last year’s rate.

- The City calculates the proposed property tax rate after the receipt of the certified initial roll from Harris County, Fort Bend County, and Montgomery County Appraisal District.

The property tax rate calculations include numerous variables and assumptions, a couple of variables including current year collection rate, Tax Increment Reinvestment Zone transfer, and delinquent tax year collections.

Since the City must comply with Proposition 1 revenue cap, the total property

tax revenue is a known factor in the property tax rate setting process.

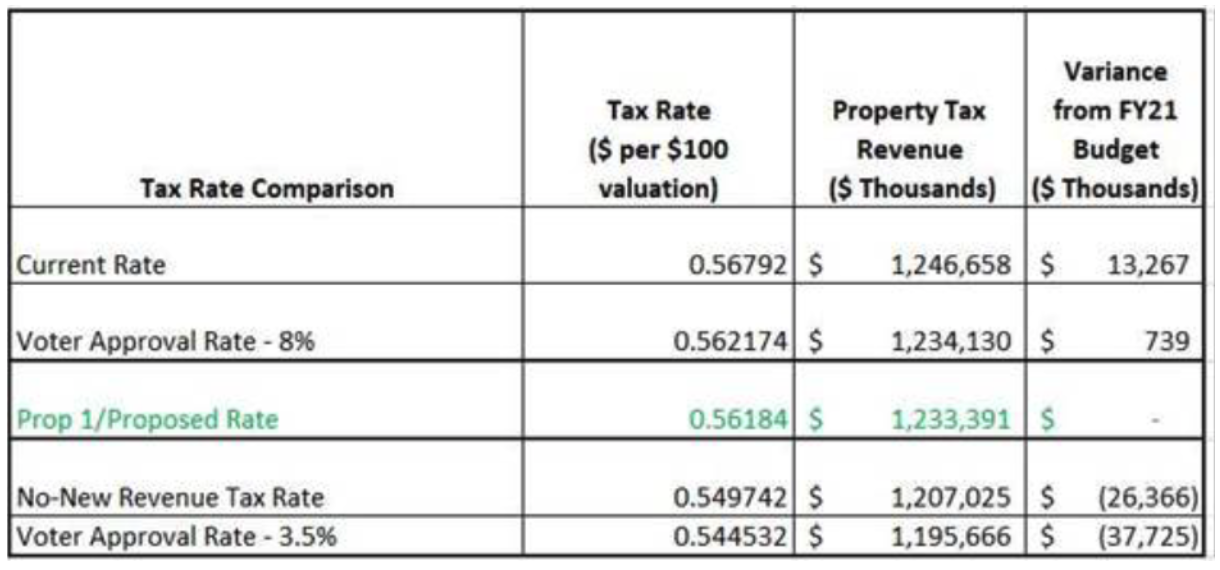

After applying the City’s own revenue cap tax rate, the rate was applied to the calculations laid out in Senate Bill 2. The Chart below depicts the City of Houston calculations based on the various tax rates and the impact to the budgeted/Proposition 1 Revenue Cap.

The key lines include the Voter Approval Rate (VAR) at 3.5% and at 8% and revenue collected under each in comparison to the Current Rate of .56792.

To be clear, the Voter Approval Rate with a 3.5% cap would yield almost $38 million in less revenue for the City of Houston. Using the 8% calculation would yield Houston with less than $1 million over the FY 2021 Budget.

The reason these numbers are more complicated to calculate are because of Houston’s own revenue cap.

- Members of the Texas House of Representatives unanimously adopted an amendment that would have eliminated this duplicitous situation by making Senate Bill 2 a uniform statewide property tax policy.

When the Conference Committee failed to adopt this amendment, Houston was forced to comply with both property tax caps - a situation not anticipated in either statute. Houston did not use “a loophole” in Senate Bill 2 (which capped revenue growth up to 3.5%) to land at a rate less than 1% higher than last year’s rate.

Loopholes are made to avoid consequences; Houston has endured both restrictions.